The Income tax department made it compulsory to link PAN card with Aadhaar and made it easy for taxpayers to link their PAN with Aadhaar. The Tax payers are directed to use the simplified process to complete the linking of Aadhaar with PAN as early as possible. This will be useful for E-Verification of Income Tax returns. This new feature does not even require to login or register at the e- filing website.

Steps to link Aadhaar with PAN

Step 2: Click the 'Link Aadhaar' available on the left portion.

Step 3: Provide PAN Card No, Aadhaar no. and enter your Name Exactly as given in Aadhaar Card, Type the CAPTCHA code displayed in the screen and finally click the Link Aadhaar Button.

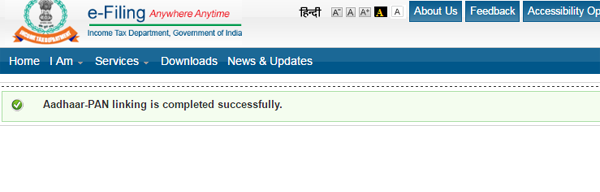

Step 4: Now the portal will display the message "Aadhar PAN Linking is completed successfully"

In some case where Aadhaar name is completely different from name in PAN, then the linking will fail and taxpayer will be prompted to change the name in either Aadhaar or in PAN database. To update your PAN details follow the link https://www.onlineservices.nsdl.com/paam/endUserRegisterContact.html or To update your Aadhaar card details please follow the link https://ssup.uidai.gov.in/web/guest/update